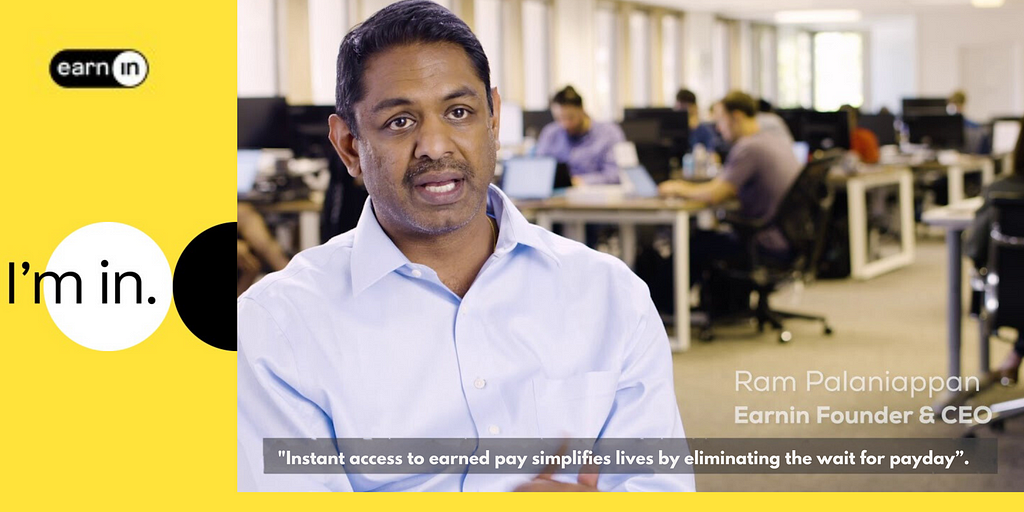

The Story Behind EarnIn’s $10 Million Dollar Debt Forgiveness: An Interview with CEO Ram Palaniappan

In today’s rapidly evolving technological landscape, the drive for speed and accuracy often dominates the conversation. Yet, there are visionary leaders who focus on the problems in front of them and leverage technology to solve real-world issues, today. These pioneers understand that with the right tools, businesses can make a profound social impact and address pressing issues that have long been a chronic problem. In this interview, I had an opportunity to speak with one of these forward-thinking leaders, Ram Palaniappan.

Ram Palaniappan is the founder and CEO of EarnIn, a fintech company that aims to fix a financial burden by allowing individuals to access their earned wages before payday. He is an innovative entrepreneur with over two decades of experience founding multiple fintech startups, driven by a passion for helping people achieve financial peace of mind. Palaniappan was inspired to start EarnIn after assisting his own employees who needed money before payday by writing them personal checks.

Thank you for joining us. Could you start by sharing a little about how you started EarnIn?

At my first company, in Cincinnati, Ohio, I discovered some of my employees were struggling with overdraft fees and payday loans. One of the employees couldn’t wait until she was paid. I wanted to help so I paid her myself because my payroll system couldn’t do it for me. I had to deduct the amount from her next pay. This is how I came up with the idea behind EarnIn.

So what does your company actually do?

Our goal is to help people get to a better place financially. We believe that financial products shouldn’t cost as much as they do. We give people access to their hard-earned money when they need it, without making them wait until their next paycheck.

We also want to help people manage their finances so we give users an option to automatically set aside a portion of their pay to help them budget their expenses.

More recently, we started introducing free credit monitoring, which has been very popular because it helps people stay on top of their credit scores.

What was one of the hardest challenges you faced while growing EarnIn, and how did you overcome it?

COVID-19 was tough. So many people lost their jobs or couldn’t go to work, It was difficult, but it also pushed us to diversify and find new ways to support our customers.

Can you share what specifically led to your decision to write off more than 10 million dollars of debt for so many people?

We built a relationship with ForgiveCo because they could do something we couldn’t. They were the bridge that helped close the gap between the debt and all of the details that go into an initiative like this.

What makes the collaboration so special is how much more efficient we could be compared to individuals, simply because we could get the debt in bulk and negotiate better pay-off terms. ForgiveCo was able to bundle more than $10 million dollars of consumer debt for approx 9,000 people.

The impact has been great and so many people have expressed relief and gratitude. One person described it as having a “1,000-pound weight lifted off their chest.” It’s satisfying to see how this initiative has helped people move forward financially.

I spoke to one of your benefactors. You had quite an impact.

What are you hoping to gain from doing this initiative?

We know that debt is the number one pain point for so many consumers. There is something extremely satisfying in wiping out so much debt for so many people. That in itself is worth the investment. This initiative aligns with our company’s purpose and the more people we can help, the better.

You mentioned all of the free services you offer. Why do you give away so many services for free?

For instance, an overdraft fee is typically $35, but the technology behind it is quite simple. We question why financial services are so expensive when much of it is now digital. Giving our users no cost access to their earnings will help them save more of their hard-earned money so they can work towards a strong financial future.

What drives you and your team to continue innovating in the financial services space?

We’re driven by the desire to fix a financial system that works poorly for so many people. The technology already exists to make significant improvements, and we want to apply it in ways that benefit consumers.

“Our motto is that yesterday’s solutions don’t work for today’s problems”

We need new financial products to address the growing wealth gap and promote financial inclusion. Building solutions that lead to better outcomes for consumers is what excites us and keeps us moving forward.

Can you provide some practical financial advice for our readers based on your experience?

One key piece of advice is to actively manage your pay cycle and consider using a tool that gives you access to earnings to avoid paying late fees or overdrafts. Set aside some of your savings to help if unexpected expenses come up. Establish a way to save automatically and work towards a system that helps you manage your monthly bills and unexpected expenses more effectively. Staying informed about your credit score is crucial. Utilize free monitoring tools to keep track of your credit, as this can help you identify and address issues early on. Lastly, leverage technology to better manage your finances. Many modern financial tools and apps offer features that can help you maintain better financial health, far beyond what was possible 10–15 years ago.

What trends do you foresee in the future of financial health and technology?

I believe payroll will eventually move from batch processing to continuous processing. Meaning, you’ll eventually see the money you’ve earned in your bank account in real-time, rather than waiting for a bi-weekly or monthly payday. The technology for this already exists; it’s just a matter of changing the systems we use. This shift could significantly improve financial management and stability for many people.

How can people find out more about EarnIn and start using your services?

People can visit our website at EarnIn.com and download our app from the iOS App Store or Google Play Store.

Great. And, thank you so much for your time. I hope more people find out about your debt relief program and that it inspires more companies to give back to the communities that support their businesses.

EarnIn, is a pioneer in on-demand pay, announced that the company has relieved over $10.6 million in consumer debt through a partnership with ForgiveCo. With American household debt totaling over $17 trillion by the end of Q1 2024, consumers are still facing an uphill battle with high rates of inflation and rising daily costs, and EarnIn is addressing this debt crisis head on. EarnIn’s debt relief impacts multiple sources of debt, primarily credit cards and auto loans, which are two major categories for Georgia residents.

About the Interviewer: Chad Silverstein, a seasoned entrepreneur with over two decades of experience as the Founder and CEO of multiple companies. He launched Choice Recovery, Inc., a healthcare collection agency, while going to The Ohio State University. His team earned national recognition, twice being ranked as the #1 business to work for in Central Ohio. In 2018, Chad launched [re]start, a career development platform connecting thousands of individuals in collections with meaningful employment opportunities. He sold Choice Recovery on his 25th anniversary and in 2023, sold the majority interest in [re]start so he can focus his transition to Built to Lead as an Executive Leadership Coach. Learn more at www.chadsilverstein.com

The Story Behind EarnIn’s $10 Million Dollar Debt Forgiveness: An Interview with CEO Ram… was originally published in Authority Magazine on Medium, where people are continuing the conversation by highlighting and responding to this story.