The B Corp Advantage: Peter Krajsa Of National Energy Improvement Fund On Unlocking the Benefits of Purpose-Driven Certification

An Interview With Russ McLeod

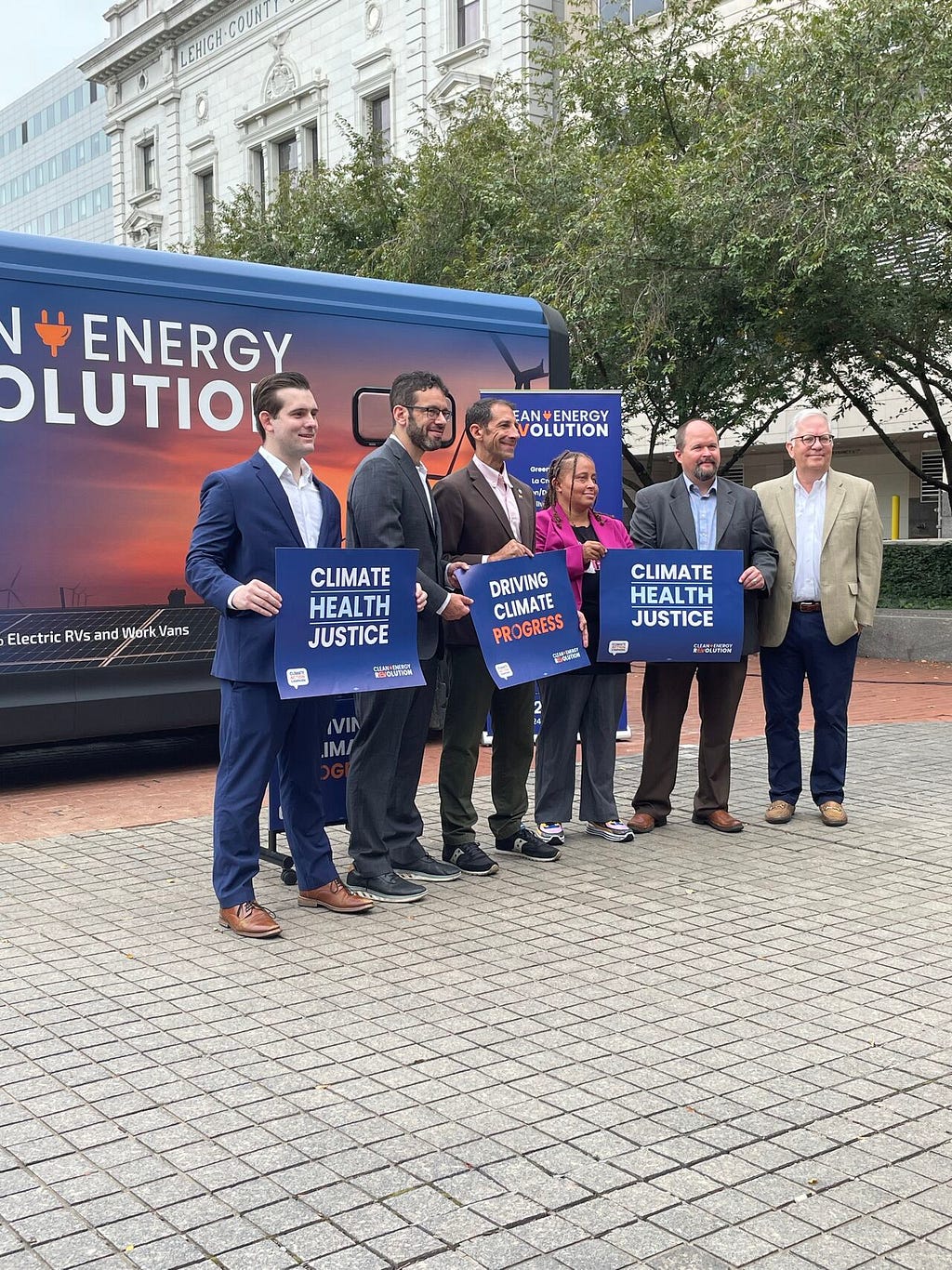

Providing a clear and visible message of mission to customers, vendors, staff and community.

In today’s market, businesses are increasingly recognized not just for their profitability but for their commitment to social and environmental responsibility. Becoming a B Corp certified company represents a dedication to a broader purpose and a positive impact on society. What are the tangible benefits of this certification, and how can businesses leverage it to unlock new opportunities? I had the pleasure of interviewing Peter Krajsa.

Peter Krajsa has been a recognized innovator in energy efficiency finance for over two decades. He co-founded the National Energy Improvement Fund (NEIF) in 2018 with fellow Co-Chair, Matthew Brown and COO, Laura Nelson as the nation’s first Certified Benefit Corporation (B Corp) lender focused on increasing the affordability of essential energy efficiency improvements. Previously, he spearheaded the creation of major national energy finance programs as CEO of his family’s business, AFC First Financial Corporation, a specialty energy lender and mortgage banker founded in 1947, and then heading national channel business development for the innovative energy lender, Renew Financial, which acquired AFC First in 2015.

Thank you so much for doing this with us! Our readers would love to get to know you a bit better. Can you share a bit about your background and what led you to your current role?

Entrepreneurship and community engagement is part of my DNA. My grandparents migrated from Slovakia in the 1910’s. They worked in mills and factories until, for some reason, my grandfather decided to open a grocery store in the middle of the Depression. He often extended credit to customers for groceries and essentials and his store became a community hub. My father was the first person from that generation of Allentown immigrant families to attend college, playing basketball and baseball at Villanova. With a degree in Finance, he ended up in consumer lending, and eventually opened the first state regulated licensed lender, with a primary focus of providing credit to the immigrant community. As markets changed and I joined the company after graduating from Wharton, my brother and I converted AFC First to a primary mortgage bank and home improvement lender. I attended a Fannie Mae conference in 1999 and learned about a new product, “energy efficiency lending”. We became one of Fannie Mae’s pilot energy lenders and expanded our business on the East Coast, providing fair, fixed rate financing to homeowners for essential energy improvements. We began running energy efficiency financing programs for states and utilities, including the flagship Keystone Home Energy Loan Program with Pennsylvania Treasury. I sold AFC First in 2015 to a national energy lender, and then re-assembled much of our team to found the National Energy Improvement Fund in 2018 with Matthew Brown and Laura Nelson.

What is your organization’s mission? Who are your customers and how do you serve them?

Affordability is the greatest impediment to the adoption of home and building energy efficiency and electrification upgrades. They are expensive and often unexpected. Rebates only cover a small portion of the cost and traditional financing is typically short term “teaser” rates, high cost to contractor or involves a cumbersome loan process. NEIF is focused on improving the delivery channel of higher efficiency improvements through effective financing, increasing the affordability of those improvements to borrowers of all income levels and helping quality-focused contractors grow their businesses. NEIF partners with contractors, manufacturers, distributors, governments, utilities, and industry trade groups to develop and administer financing and related programs designed to help improve the uptake of essential energy improvements to homes and businesses. These include heating and cooling systems; building envelope improvements (windows, doors, roofing and insulation); lighting; generators, and other energy related improvements.

What inspired your organization to pursue B Corp certification?

I grew up in a business environment where my grandparents and my dad and my mom taught me three fundamentals: 1) Offer a good product or service, whatever that might be; 2) Have a fair and equitable work environment that you work with your staff and all your customers and to try to do the right thing; and then 3) Make money. And they kind of were all equal priorities. And that’s the way that I’ve always viewed American capitalism, in a more holistic way. It’s not just about profit. We certainly want to make money, but we also want to do the right thing. So, when we were organizing the National Energy Improvement Fund, I learned about benefit corporations and realized that was the direction we wanted to take as it embodied our mission and the way we intended to do business.

Could you tell us about your journey in the industry and any significant experiences that have shaped your approach to building an organization that is focused on its impact?

When I sold my family business to a private-equity backed firm, I ultimately realized the enormous difference in motivations (at least in this situation). Volume at all costs, out-spending resources, not listening to customers, purely financially driven. When I decided to start NEIF with Matthew and Laura we were in agreement that we wanted to conduct our business in the right way and for the right reasons. Having this commonality of thought between senior leaders has made adherence to B Corp standards an ingrained part of our company culture.

Can you describe the process your organization went through to achieve B Corp certification? What were the biggest challenges and how did you overcome them?

The process to apply is straightforward. We were fortunate that due to our internal focus on compliance we already had most of the required policies in place. That may be more difficult for a smaller business or one that does not have an internal compliance team.

Where did your business perform well in your B Corp assessment?

NEIF scored above average in Governance, Workers, Community and Environment.

In what areas did the assessment open your eyes to where your organization could do better?

While we do show environmental impact in our annual benefit report, we can improve regular communication on the environmental impact of the products we finance.

How do you measure and ensure ongoing compliance with B Corp standards, and what steps do you take to continually improve?

As a regulated financial institution, compliance with fair lending and corporate policies are an essential part of our business. We monitor customer interactions and act swiftly on any issues that do not comply with our procedures and policies. We have a Compliance Officer who is continuously reviewing and updating policy to adhere to B Corp standards.

B Corp certification represents a commitment to sustainability (environment, governance and people). When you look at your long-term business strategy, how does the vision for your company interact with your commitment to sustainability?

Every NEIF loan funds a project that reduces greenhouse gas emissions. Our slogan is “Go Greener, Affordably”. To date, NEIF has funded over 20,000 energy efficiency and electrification projects.

How has B Corp certification influenced your decision-making processes, particularly around sustainability and social impact?

We only work with contractors who have demonstrated financial and ethical stability and employ, to the best of our knowledge, fair and transparent practices when dealing with consumers. All contractors who offer NEIF financing go through an extensive vetting and approval process and are continuously monitored. NEIF specifically does not engage in financing programs with artificially reduced interest rates that require a high dealer discount or result in hidden fees to consumers.

Can you provide an example of how being a B Corp has enhanced your relationships with employees, customers, or partners?

We think of it as operating a company with a heart and a soul and a purpose. Our mission and culture is completely rooted in sustainability, transparency, fair lending, and improving the affordability of energy efficiency. We are committed to maintaining a culture based on this altruism. But they are also pragmatic benefits. It’s helped us with employee recruitment, attracting people that would prefer to work for a company that has a moral and social compass. And it allows us to differentiate ourselves from other financial institutions. Program partners like states, green banks, energy offices and utilities relate to our differentiation as a B Corp.

What are your “Top 5 Benefits of Getting a B Corp Certification”?

1 . Third party evaluation and recognition of positive business practices.

2 . Providing a clear and visible message of mission to customers, vendors, staff and community.

3 . Publicly “Walking the Talk” of adherence to a moral and social purpose.

4 . Appeal to like-minded customers and business partners.

5 . Differentiation from competitors in program bidding and RFP responses.

What do you believe is the future of purpose-driven certifications like B Corp, and how can organizations stay ahead in this evolving field?

You can “do well while doing good”. Customers respond to purpose-driven companies and third-party assessment is both a verification and a public anointment that differentiates organizations in the market-place.

What advice do you have for organizations looking to embrace purpose-driven certification, like B Corp?

If you don’t have policies in place now, the B Corp certification process will ensure you do. Policies are critical as it gives a company a sense of order and a transparent “rule book” for management, staff and other stakeholders.

Who has been a major influence or inspiration for your work in the purpose-driven business space?

I was inspired by my father who embraced the tenets of B Corp long before the term existed. He strongly believed in character and integrity, providing a product that provided a benefit, fairness in lending practices and respecting and enjoying those that you work with.

How can our readers further follow your work or your company online?

Learn more about us by visiting www.neifund.org!

This was great. Thanks for taking time for us to learn more about you and your business. We wish you continued success!

About the Interviewer: Russell McLeod is an experienced business leader, social entrepreneur, and mentor. A champion of profit with purpose, the circular economy and of collaboration for positive progress. Russell is the founder of Mightyhum a Toronto-based impact enterprise dedicated to supporting growing organizations. And, while it’s not a requirement, the Mightyhum team has a passion for collaborating with purpose-driven businesses. Mightyhum specializes in providing consulting services and turning hairy audacious concepts into achievable ventures & projects. The Mightyhum team work with C-suite executives and leaders, developing new product offerings, effective go-to-market strategies, building for profitability, and streamlining operations. Before Mightyhum, Russell was involved in the world of social enterprise as the Executive Director of ME to WE, one of Canada’s best known and most awarded social enterprises. While at ME to WE, the team demonstrated that being profitable and impactful was indeed possible. During his tenure, ME to WE delivered $20M in cash and in-kind to WE Charity, helping transform the lives of over 1 million people through access to clean water; the lives of 200,000 children with access to education; and 30,000 women-led businesses launched globally.

Russell’ personal mission is to inspire others that there is ‘a better way to do business,’ ‘that through business we can solve some of the world’s problems at the same time.’ You can follow Russell’s work at https://www.linkedin.com/in/russell-mcleod1/ or www.mightyhum.com.

The B Corp Advantage: Peter Krajsa Of National Energy Improvement Fund On Unlocking the Benefits of… was originally published in Authority Magazine on Medium, where people are continuing the conversation by highlighting and responding to this story.